| Date | NAV | NAV Change |

|---|---|---|

| 7/25/2024 | $9.51 | $-0.04 |

| 7/24/2024 | $9.55 | $0.08 |

| 7/23/2024 | $9.47 | $-0.08 |

| 7/22/2024 | $9.55 | $0.12 |

| 7/19/2024 | $9.43 | $-0.03 |

| 7/18/2024 | $9.46 | $-0.02 |

| 7/17/2024 | $9.48 | $-0.05 |

| 7/16/2024 | $9.53 | $0.09 |

| 7/15/2024 | $9.44 | $-0.24 |

| 7/12/2024 | $9.68 | $0.08 |

| 7/11/2024 | $9.60 | $0.23 |

| 7/10/2024 | $9.37 | $0.09 |

| 7/09/2024 | $9.28 | $-0.03 |

| 7/08/2024 | $9.31 | $-0.06 |

| 7/05/2024 | $9.37 | $0.07 |

| 7/03/2024 | $9.30 | $0.14 |

| 7/02/2024 | $9.16 | $0.05 |

| 7/01/2024 | $9.11 | $-0.06 |

| 6/28/2024 | $9.17 | $-0.11 |

| 6/27/2024 | $9.28 | $-0.01 |

| 6/26/2024 | $9.29 | $-0.07 |

| 6/25/2024 | $9.36 | $-0.06 |

| 6/24/2024 | $9.42 | $0.10 |

| 6/21/2024 | $9.32 | $-0.03 |

| 6/20/2024 | $9.35 | $0.01 |

| 6/18/2024 | $9.34 | $0.09 |

| 6/17/2024 | $9.25 | $-0.14 |

| 6/14/2024 | $9.39 | $-0.08 |

| 6/13/2024 | $9.47 | $-0.08 |

| 6/12/2024 | $9.55 | $0.01 |

| 6/11/2024 | $9.54 | $-0.13 |

| 6/10/2024 | $9.67 | $0.05 |

| 6/07/2024 | $9.62 | $-0.08 |

| 6/06/2024 | $9.70 | $-0.12 |

| 6/05/2024 | $9.82 | $0.03 |

| 6/04/2024 | $9.79 | $0.03 |

| 6/03/2024 | $9.76 | $0.01 |

| 5/31/2024 | $9.75 | $0.18 |

| 5/30/2024 | $9.57 | $0.21 |

| 5/29/2024 | $9.36 | $-0.20 |

| 5/28/2024 | $9.56 | $0.07 |

| 5/24/2024 | $9.49 | $0.12 |

| 5/23/2024 | $9.37 | $-0.38 |

| 5/22/2024 | $9.75 | $-0.01 |

| 5/21/2024 | $9.76 | $0.01 |

| 5/20/2024 | $9.75 | $-0.02 |

| 5/17/2024 | $9.77 | $-0.11 |

| 5/16/2024 | $9.88 | $0.00 |

| 5/15/2024 | $9.88 | $0.18 |

| 5/14/2024 | $9.70 | $0.06 |

| 5/13/2024 | $9.64 | $-0.04 |

| 5/10/2024 | $9.68 | $0.07 |

| 5/09/2024 | $9.61 | $0.13 |

| 5/08/2024 | $9.48 | $0.03 |

| 5/07/2024 | $9.45 | $0.03 |

| 5/06/2024 | $9.42 | $0.10 |

| 5/03/2024 | $9.32 | $0.15 |

| 5/02/2024 | $9.17 | $0.14 |

| 5/01/2024 | $9.03 | $0.08 |

| 4/30/2024 | $8.95 | $-0.11 |

| 4/29/2024 | $9.06 | $0.11 |

| 4/26/2024 | $8.95 | $-0.03 |

| 4/25/2024 | $8.98 | $-0.04 |

| 4/24/2024 | $9.02 | $0.04 |

| 4/23/2024 | $8.98 | $0.15 |

| 4/22/2024 | $8.83 | $0.05 |

| 4/19/2024 | $8.78 | $0.08 |

| 4/18/2024 | $8.70 | $0.06 |

| 4/17/2024 | $8.64 | $0.13 |

| 4/16/2024 | $8.51 | $-0.09 |

| 4/15/2024 | $8.60 | $-0.16 |

| 4/12/2024 | $8.76 | $-0.08 |

| 4/11/2024 | $8.84 | $0.08 |

| 4/10/2024 | $8.76 | $-0.20 |

| 4/09/2024 | $8.96 | $0.08 |

| 4/08/2024 | $8.88 | $0.07 |

| 4/05/2024 | $8.81 | $-0.03 |

| 4/04/2024 | $8.84 | $0.04 |

| 4/03/2024 | $8.80 | $-0.01 |

| 4/02/2024 | $8.81 | $0.03 |

| 4/01/2024 | $8.78 | $-0.04 |

| 3/28/2024 | $8.82 | $0.04 |

| 3/27/2024 | $8.78 | $0.17 |

| 3/26/2024 | $8.61 | $-0.06 |

| 3/25/2024 | $8.67 | $-0.01 |

| 3/22/2024 | $8.68 | $0.05 |

| 3/21/2024 | $8.63 | $-0.05 |

| 3/20/2024 | $8.68 | $0.06 |

| 3/19/2024 | $8.62 | $0.00 |

| 3/18/2024 | $8.62 | $-0.04 |

| 3/15/2024 | $8.66 | $0.01 |

| 3/14/2024 | $8.65 | $0.02 |

| 3/13/2024 | $8.63 | $-0.03 |

| 3/12/2024 | $8.66 | $-0.12 |

| 3/11/2024 | $8.78 | $-0.01 |

| 3/08/2024 | $8.79 | $0.01 |

| 3/07/2024 | $8.78 | $0.10 |

| 3/06/2024 | $8.68 | $0.19 |

| 3/05/2024 | $8.49 | $0.03 |

| 3/04/2024 | $8.46 | $0.01 |

| 3/01/2024 | $8.45 | $0.02 |

| 2/29/2024 | $8.43 | $0.06 |

| 2/28/2024 | $8.37 | $-0.05 |

| 2/27/2024 | $8.42 | $0.14 |

| 2/26/2024 | $8.28 | $-0.13 |

| 2/23/2024 | $8.41 | $0.01 |

| 2/22/2024 | $8.40 | $-0.04 |

| 2/21/2024 | $8.44 | $0.03 |

| 2/20/2024 | $8.41 | $-0.02 |

| 2/16/2024 | $8.43 | $-0.04 |

| 2/15/2024 | $8.47 | $0.13 |

| 2/14/2024 | $8.34 | $0.03 |

| 2/13/2024 | $8.31 | $-0.17 |

| 2/12/2024 | $8.48 | $0.10 |

| 2/09/2024 | $8.38 | $-0.03 |

| 2/08/2024 | $8.41 | $-0.10 |

| 2/07/2024 | $8.51 | $0.00 |

| 2/06/2024 | $8.51 | $0.02 |

| 2/05/2024 | $8.49 | $-0.21 |

| 2/02/2024 | $8.70 | $-0.18 |

| 2/01/2024 | $8.88 | $0.09 |

| 1/31/2024 | $8.79 | $0.01 |

| 1/30/2024 | $8.78 | $-0.02 |

| 1/29/2024 | $8.80 | $0.04 |

| 1/26/2024 | $8.76 | $-0.04 |

| 1/25/2024 | $8.80 | $0.12 |

| 1/24/2024 | $8.68 | $-0.06 |

| 1/23/2024 | $8.74 | $-0.03 |

| 1/22/2024 | $8.77 | $0.03 |

| 1/19/2024 | $8.74 | $0.00 |

| 1/18/2024 | $8.74 | $-0.08 |

| 1/17/2024 | $8.82 | $-0.21 |

| 1/16/2024 | $9.03 | $-0.20 |

| 1/12/2024 | $9.23 | $0.04 |

| 1/11/2024 | $9.19 | $-0.13 |

| 1/10/2024 | $9.32 | $-0.03 |

| 1/09/2024 | $9.35 | $-0.07 |

| 1/08/2024 | $9.42 | $0.10 |

| 1/05/2024 | $9.32 | $0.02 |

| 1/04/2024 | $9.30 | $0.01 |

| 1/03/2024 | $9.29 | $-0.08 |

| 1/02/2024 | $9.37 | $-0.10 |

| 12/29/2023 | $9.47 | $0.00 |

| 12/28/2023 | $9.47 | $-0.04 |

| 12/27/2023 | $9.51 | $0.05 |

| 12/26/2023 | $9.46 | $0.05 |

| 12/22/2023 | $9.41 | $0.01 |

| 12/21/2023 | $9.40 | $0.17 |

| 12/20/2023 | $9.23 | $-0.13 |

| 12/19/2023 | $9.36 | $0.11 |

| 12/18/2023 | $9.25 | $-0.07 |

| 12/15/2023 | $9.32 | $-0.07 |

| 12/14/2023 | $9.39 | $0.18 |

| 12/13/2023 | $9.21 | $0.32 |

| 12/12/2023 | $8.89 | $-0.07 |

| 12/11/2023 | $8.96 | $-0.06 |

| 12/08/2023 | $9.02 | $0.02 |

| 12/07/2023 | $9.00 | $0.00 |

| 12/06/2023 | $9.00 | $0.12 |

| 12/05/2023 | $8.88 | $0.01 |

| 12/04/2023 | $8.87 | $-0.05 |

| 12/01/2023 | $8.92 | $0.10 |

| 11/30/2023 | $8.82 | $0.02 |

| 11/29/2023 | $8.80 | $0.00 |

| 11/28/2023 | $8.80 | $-0.02 |

| 11/27/2023 | $8.82 | $0.00 |

| 11/24/2023 | $8.82 | $0.00 |

| 11/22/2023 | $8.82 | $-0.02 |

| 11/21/2023 | $8.84 | $-0.09 |

| 11/20/2023 | $8.93 | $0.09 |

| 11/17/2023 | $8.84 | $0.02 |

| 11/16/2023 | $8.82 | $-0.02 |

| 11/15/2023 | $8.84 | $0.03 |

| 11/14/2023 | $8.81 | $0.44 |

| 11/13/2023 | $8.37 | $-0.04 |

| 11/10/2023 | $8.41 | $-0.03 |

| 11/09/2023 | $8.44 | $-0.13 |

| 11/08/2023 | $8.57 | $-0.09 |

| 11/07/2023 | $8.66 | $-0.05 |

| 11/06/2023 | $8.71 | $-0.06 |

| 11/03/2023 | $8.77 | $0.16 |

| 11/02/2023 | $8.61 | $0.25 |

| 11/01/2023 | $8.36 | $0.06 |

| 10/31/2023 | $8.30 | $0.02 |

| 10/30/2023 | $8.28 | $0.07 |

| 10/27/2023 | $8.21 | $-0.10 |

| 10/26/2023 | $8.31 | $0.10 |

| 10/25/2023 | $8.21 | $-0.02 |

| 10/24/2023 | $8.23 | $0.22 |

| 10/23/2023 | $8.01 | $-0.03 |

| 10/20/2023 | $8.04 | $-0.10 |

| 10/19/2023 | $8.14 | $-0.03 |

| 10/18/2023 | $8.17 | $-0.10 |

| 10/17/2023 | $8.27 | $0.00 |

| 10/16/2023 | $8.27 | $0.08 |

| 10/13/2023 | $8.19 | $-0.03 |

| 10/12/2023 | $8.22 | $-0.13 |

| 10/11/2023 | $8.35 | $0.08 |

| 10/10/2023 | $8.27 | $0.25 |

| 10/09/2023 | $8.02 | $0.01 |

| 10/06/2023 | $8.01 | $0.15 |

| 10/05/2023 | $7.86 | $0.01 |

| 10/04/2023 | $7.85 | $-0.03 |

| 10/03/2023 | $7.88 | $-0.18 |

| 10/02/2023 | $8.06 | $-0.37 |

| 9/29/2023 | $8.43 | $0.04 |

| 9/28/2023 | $8.39 | $-0.16 |

| 9/27/2023 | $8.55 | $-0.34 |

| 9/26/2023 | $8.89 | $-0.17 |

| 9/25/2023 | $9.06 | $-0.09 |

| 9/22/2023 | $9.15 | $-0.03 |

| 9/21/2023 | $9.18 | $-0.18 |

| 9/20/2023 | $9.36 | $-0.03 |

| 9/19/2023 | $9.39 | $-0.04 |

| 9/18/2023 | $9.43 | $-0.07 |

| 9/15/2023 | $9.50 | $-0.10 |

| 9/14/2023 | $9.60 | $0.14 |

| 9/13/2023 | $9.46 | $0.05 |

| 9/12/2023 | $9.41 | $-0.01 |

| 9/11/2023 | $9.42 | $0.04 |

| 9/08/2023 | $9.38 | $0.06 |

| 9/07/2023 | $9.32 | $0.04 |

| 9/06/2023 | $9.28 | $-0.08 |

| 9/05/2023 | $9.36 | $-0.13 |

| 9/01/2023 | $9.49 | $-0.08 |

| 8/31/2023 | $9.57 | $-0.06 |

| 8/30/2023 | $9.63 | $-0.17 |

| 8/29/2023 | $9.80 | $0.16 |

| 8/28/2023 | $9.64 | $0.01 |

| 8/25/2023 | $9.63 | $0.07 |

| 8/24/2023 | $9.56 | $-0.01 |

| 8/23/2023 | $9.57 | $0.16 |

| 8/22/2023 | $9.41 | $0.00 |

| 8/21/2023 | $9.41 | $-0.06 |

| 8/18/2023 | $9.47 | $0.05 |

| 8/17/2023 | $9.42 | $-0.12 |

| 8/16/2023 | $9.54 | $-0.02 |

| 8/15/2023 | $9.56 | $-0.14 |

| 8/14/2023 | $9.70 | $-0.08 |

| 8/11/2023 | $9.78 | $-0.04 |

| 8/10/2023 | $9.82 | $0.02 |

| 8/09/2023 | $9.80 | $0.04 |

| 8/08/2023 | $9.76 | $-0.01 |

| 8/07/2023 | $9.77 | $-0.02 |

| 8/04/2023 | $9.79 | $0.01 |

| 8/03/2023 | $9.78 | $-0.09 |

| 8/02/2023 | $9.87 | $-0.20 |

| 8/01/2023 | $10.07 | $-0.17 |

| 7/31/2023 | $10.24 | $0.04 |

| 7/28/2023 | $10.20 | $-0.04 |

| 7/27/2023 | $10.24 | $-0.23 |

| 7/26/2023 | $10.47 | $0.05 |

| 7/25/2023 | $10.42 | $-0.02 |

| 7/24/2023 | $10.44 | $-0.03 |

| 7/21/2023 | $10.47 | $0.05 |

| 7/20/2023 | $10.42 | $0.02 |

| 7/19/2023 | $10.40 | $0.13 |

| 7/18/2023 | $10.27 | $-0.06 |

| 7/17/2023 | $10.33 | $-0.02 |

| 7/14/2023 | $10.35 | $-0.09 |

| 7/13/2023 | $10.44 | $0.10 |

| 7/12/2023 | $10.34 | $0.19 |

| 7/11/2023 | $10.15 | $0.14 |

| 7/10/2023 | $10.01 | $0.00 |

| 7/07/2023 | $10.01 | $0.05 |

| 7/06/2023 | $9.96 | $-0.20 |

| 7/05/2023 | $10.16 | $-0.07 |

| 7/03/2023 | $10.23 | $0.02 |

| 6/30/2023 | $10.21 | $0.17 |

| 6/29/2023 | $10.04 | $-0.02 |

| 6/28/2023 | $10.06 | $-0.06 |

| 6/27/2023 | $10.12 | $0.02 |

| 6/26/2023 | $10.10 | $0.07 |

| 6/23/2023 | $10.03 | $-0.21 |

| 6/22/2023 | $10.24 | $-0.10 |

| 6/21/2023 | $10.34 | $-0.02 |

| 6/20/2023 | $10.36 | $-0.11 |

| 6/16/2023 | $10.47 | $0.01 |

| 6/15/2023 | $10.46 | $0.12 |

| 6/14/2023 | $10.34 | $-0.01 |

| 6/13/2023 | $10.35 | $-0.04 |

| 6/12/2023 | $10.39 | $-0.01 |

| 6/09/2023 | $10.40 | $0.02 |

| 6/08/2023 | $10.38 | $0.05 |

| 6/07/2023 | $10.33 | $-0.01 |

| 6/06/2023 | $10.34 | $0.04 |

| 6/05/2023 | $10.30 | $0.00 |

| 6/02/2023 | $10.30 | $0.07 |

| 6/01/2023 | $10.23 | $0.09 |

| 5/31/2023 | $10.14 | $-0.07 |

| 5/30/2023 | $10.21 | $0.03 |

| 5/26/2023 | $10.18 | $-0.01 |

| 5/25/2023 | $10.19 | $-0.28 |

| 5/24/2023 | $10.47 | $-0.12 |

| 5/23/2023 | $10.59 | $-0.03 |

| 5/22/2023 | $10.62 | $0.08 |

| 5/19/2023 | $10.54 | $0.00 |

| 5/18/2023 | $10.54 | $-0.12 |

| 5/17/2023 | $10.66 | $-0.05 |

| 5/16/2023 | $10.71 | $-0.07 |

| 5/15/2023 | $10.78 | $0.09 |

| 5/12/2023 | $10.69 | $0.05 |

| 5/11/2023 | $10.64 | $-0.04 |

| 5/10/2023 | $10.68 | $0.01 |

| 5/09/2023 | $10.67 | $0.01 |

| 5/08/2023 | $10.66 | $0.01 |

| 5/05/2023 | $10.65 | $0.12 |

| 5/04/2023 | $10.53 | $0.06 |

| 5/03/2023 | $10.47 | $-0.02 |

| 5/02/2023 | $10.49 | $-0.13 |

| 5/01/2023 | $10.62 | $-0.04 |

| 4/28/2023 | $10.66 | $0.03 |

| 4/27/2023 | $10.63 | $0.15 |

| 4/26/2023 | $10.48 | $-0.16 |

| 4/25/2023 | $10.64 | $-0.18 |

| 4/24/2023 | $10.82 | $-0.02 |

| 4/21/2023 | $10.84 | $0.05 |

| 4/20/2023 | $10.79 | $-0.03 |

| 4/19/2023 | $10.82 | $0.06 |

| 4/18/2023 | $10.76 | $-0.12 |

| 4/17/2023 | $10.88 | $0.06 |

| 4/14/2023 | $10.82 | $-0.14 |

| 4/13/2023 | $10.96 | $0.08 |

| 4/12/2023 | $10.88 | $0.01 |

| 4/11/2023 | $10.87 | $0.08 |

| 4/10/2023 | $10.79 | $-0.05 |

| 4/06/2023 | $10.84 | $0.03 |

| 4/05/2023 | $10.81 | $0.09 |

| 4/04/2023 | $10.72 | $0.05 |

| 4/03/2023 | $10.67 | $-0.08 |

| 3/31/2023 | $10.75 | $0.10 |

| 3/30/2023 | $10.65 | $0.18 |

| 3/29/2023 | $10.47 | $0.05 |

| 3/28/2023 | $10.42 | $-0.01 |

| 3/27/2023 | $10.43 | $0.09 |

| 3/24/2023 | $10.34 | $0.09 |

| 3/23/2023 | $10.25 | $-0.05 |

| 3/22/2023 | $10.30 | $-0.07 |

| 3/21/2023 | $10.37 | $0.03 |

| 3/20/2023 | $10.34 | $0.06 |

| 3/17/2023 | $10.28 | $-0.12 |

| 3/16/2023 | $10.40 | $0.05 |

| 3/15/2023 | $10.35 | $-0.14 |

| 3/14/2023 | $10.49 | $0.18 |

| 3/13/2023 | $10.31 | $0.09 |

| 3/10/2023 | $10.22 | $-0.12 |

| 3/09/2023 | $10.34 | $-0.10 |

| 3/08/2023 | $10.44 | $0.06 |

| 3/07/2023 | $10.38 | $-0.12 |

| 3/06/2023 | $10.50 | $-0.02 |

| 3/03/2023 | $10.52 | $0.19 |

| 3/02/2023 | $10.33 | $0.08 |

| 3/01/2023 | $10.25 | $-0.13 |

| 2/28/2023 | $10.38 | $-0.05 |

| 2/27/2023 | $10.43 | $0.02 |

| 2/24/2023 | $10.41 | $-0.09 |

| 2/23/2023 | $10.50 | $-0.15 |

| 2/22/2023 | $10.65 | $-0.13 |

| 2/21/2023 | $10.78 | $-0.11 |

| 2/17/2023 | $10.89 | $0.02 |

| 2/16/2023 | $10.87 | $-0.06 |

| 2/14/2023 | $10.90 | $0.03 |

| 2/13/2023 | $10.87 | $0.06 |

| 2/10/2023 | $10.81 | $0.02 |

| 2/09/2023 | $10.79 | $-0.10 |

| 2/08/2023 | $10.89 | $-0.06 |

| 2/07/2023 | $10.95 | $0.02 |

| 2/06/2023 | $10.93 | $0.00 |

| 2/03/2023 | $10.93 | $-0.21 |

| 2/02/2023 | $11.14 | $0.08 |

| 2/01/2023 | $11.06 | $0.02 |

| 1/31/2023 | $11.04 | $0.11 |

| 1/30/2023 | $10.93 | $-0.13 |

| 1/27/2023 | $11.06 | $-0.05 |

| 1/26/2023 | $11.11 | $0.02 |

| 1/25/2023 | $11.09 | $-0.11 |

| 1/24/2023 | $11.20 | $0.00 |

| 1/23/2023 | $11.20 | $0.07 |

| 1/20/2023 | $11.13 | $0.01 |

| 1/19/2023 | $11.12 | $-0.14 |

| 1/18/2023 | $11.26 | $-0.12 |

| 1/17/2023 | $11.38 | $0.13 |

| 1/13/2023 | $11.25 | $0.01 |

| 1/12/2023 | $11.24 | $0.10 |

| 1/11/2023 | $11.14 | $0.16 |

| 1/10/2023 | $10.98 | $0.08 |

| 1/09/2023 | $10.90 | $0.04 |

| 1/06/2023 | $10.86 | $0.25 |

| 1/05/2023 | $10.61 | $-0.21 |

| 1/04/2023 | $10.82 | $0.09 |

| 1/03/2023 | $10.73 | $-0.02 |

| 12/30/2022 | $10.75 | $-0.08 |

| 12/29/2022 | $10.83 | $0.08 |

| 12/28/2022 | $10.75 | $-0.06 |

| 12/27/2022 | $10.81 | $-0.03 |

| 12/23/2022 | $10.84 | $0.04 |

| 12/22/2022 | $10.80 | $-0.12 |

| 12/21/2022 | $10.92 | $0.11 |

| 12/20/2022 | $10.81 | $0.05 |

| 12/19/2022 | $10.76 | $-0.12 |

| 12/16/2022 | $10.88 | $-0.22 |

| 12/15/2022 | $11.10 | $-0.31 |

| 12/14/2022 | $11.41 | $0.08 |

| 12/13/2022 | $11.33 | $0.09 |

| 12/12/2022 | $11.24 | $0.19 |

| 12/09/2022 | $11.05 | $-0.06 |

| 12/08/2022 | $11.11 | $-0.03 |

| 12/07/2022 | $11.14 | $-0.01 |

| 12/06/2022 | $11.15 | $-0.08 |

| 12/05/2022 | $11.23 | $-0.10 |

| 12/02/2022 | $11.33 | $-0.05 |

| 12/01/2022 | $11.38 | $0.04 |

| 11/30/2022 | $11.34 | $0.31 |

| 11/29/2022 | $11.03 | $-0.06 |

| 11/28/2022 | $11.09 | $-0.25 |

| 11/25/2022 | $11.34 | $0.05 |

| 11/23/2022 | $11.29 | $0.14 |

| 11/22/2022 | $11.15 | $-0.03 |

| 11/21/2022 | $11.18 | $-0.07 |

| 11/18/2022 | $11.25 | $0.07 |

| 11/17/2022 | $11.18 | $-0.13 |

| 11/16/2022 | $11.31 | $0.04 |

| 11/15/2022 | $11.27 | $0.10 |

| 11/14/2022 | $11.17 | $-0.15 |

| 11/11/2022 | $11.32 | $-0.12 |

| 11/10/2022 | $11.44 | $0.58 |

| 11/09/2022 | $10.86 | $-0.08 |

| 11/08/2022 | $10.94 | $0.05 |

| 11/04/2022 | $10.91 | $0.17 |

| 11/03/2022 | $10.74 | $0.06 |

| 11/02/2022 | $10.68 | $-0.16 |

| 11/01/2022 | $10.84 | $0.09 |

| 10/31/2022 | $10.75 | $-0.11 |

| 10/28/2022 | $10.86 | $0.11 |

| 10/27/2022 | $10.75 | $0.04 |

| 10/26/2022 | $10.71 | $0.09 |

| 10/25/2022 | $10.62 | $0.29 |

| 10/24/2022 | $10.33 | $0.10 |

| 10/21/2022 | $10.23 | $0.10 |

| 10/20/2022 | $10.13 | $-0.14 |

| 10/19/2022 | $10.27 | $-0.20 |

| 10/18/2022 | $10.47 | $0.12 |

| 10/17/2022 | $10.35 | $0.29 |

| 10/14/2022 | $10.06 | $-0.17 |

| 10/13/2022 | $10.23 | $0.13 |

| 10/12/2022 | $10.10 | $-0.22 |

| 10/11/2022 | $10.32 | $-0.06 |

| 10/10/2022 | $10.38 | $-0.14 |

| 10/07/2022 | $10.52 | $-0.21 |

| 10/06/2022 | $10.73 | $-0.30 |

| 10/05/2022 | $11.03 | $-0.26 |

| 10/04/2022 | $11.29 | $0.31 |

| 10/03/2022 | $10.98 | $0.36 |

| 9/30/2022 | $10.62 | $-0.06 |

| 9/29/2022 | $10.68 | $-0.35 |

| 9/28/2022 | $11.03 | $0.16 |

| 9/27/2022 | $10.87 | $-0.17 |

| 9/26/2022 | $11.04 | $-0.33 |

| 9/23/2022 | $11.37 | $-0.36 |

| 9/22/2022 | $11.73 | $-0.21 |

| 9/21/2022 | $11.94 | $-0.04 |

| 9/20/2022 | $11.98 | $-0.29 |

| 9/19/2022 | $12.27 | $0.05 |

| 9/16/2022 | $12.22 | $-0.05 |

| 9/15/2022 | $12.27 | $-0.21 |

| 9/14/2022 | $12.48 | $0.09 |

| 9/13/2022 | $12.39 | $-0.28 |

| 9/12/2022 | $12.67 | $0.09 |

| 9/09/2022 | $12.58 | $0.15 |

| 9/08/2022 | $12.43 | $0.12 |

| 9/07/2022 | $12.31 | $0.42 |

| 9/06/2022 | $11.89 | $0.02 |

| 9/02/2022 | $11.87 | $-0.15 |

| 9/01/2022 | $12.02 | $-0.03 |

| 8/31/2022 | $12.05 | $-0.08 |

| 8/30/2022 | $12.13 | $-0.19 |

| 8/29/2022 | $12.32 | $-0.06 |

| 8/26/2022 | $12.38 | $-0.29 |

| 8/25/2022 | $12.67 | $0.16 |

| 8/24/2022 | $12.51 | $0.08 |

| 8/23/2022 | $12.43 | $-0.02 |

| 8/22/2022 | $12.45 | $-0.15 |

| 8/19/2022 | $12.60 | $-0.11 |

| 8/18/2022 | $12.71 | $0.02 |

| 8/17/2022 | $12.69 | $-0.03 |

| 8/16/2022 | $12.72 | $0.06 |

| 8/15/2022 | $12.66 | $0.06 |

| 8/12/2022 | $12.60 | $0.08 |

| 8/11/2022 | $12.52 | $-0.06 |

| 8/10/2022 | $12.58 | $0.16 |

| 8/09/2022 | $12.42 | $0.02 |

| 8/08/2022 | $12.40 | $0.11 |

| 8/05/2022 | $12.29 | $0.02 |

| 8/04/2022 | $12.27 | $0.09 |

| 8/03/2022 | $12.18 | $0.04 |

| 8/02/2022 | $12.14 | $-0.05 |

| 8/01/2022 | $12.19 | $-0.06 |

| 7/29/2022 | $12.25 | $0.14 |

| 7/28/2022 | $12.11 | $0.43 |

| 7/27/2022 | $11.68 | $0.16 |

| 7/26/2022 | $11.52 | $-0.01 |

| 7/25/2022 | $11.53 | $0.13 |

| 7/22/2022 | $11.40 | $0.06 |

| 7/21/2022 | $11.34 | $-0.05 |

| 7/20/2022 | $11.39 | $-0.18 |

| 7/19/2022 | $11.57 | $0.07 |

| 7/18/2022 | $11.50 | $0.08 |

| 7/15/2022 | $11.42 | $0.03 |

| 7/14/2022 | $11.39 | $-0.16 |

| 7/13/2022 | $11.55 | $0.03 |

| 7/12/2022 | $11.52 | $-0.10 |

| 7/11/2022 | $11.62 | $-0.05 |

| 7/08/2022 | $11.67 | $0.02 |

| 7/07/2022 | $11.65 | $0.20 |

| 7/06/2022 | $11.45 | $0.00 |

| 7/05/2022 | $11.45 | $-0.17 |

| 7/01/2022 | $11.62 | $0.25 |

| 6/30/2022 | $11.37 | $0.08 |

| 6/29/2022 | $11.29 | $-0.14 |

| 6/28/2022 | $11.43 | $-0.06 |

| 6/27/2022 | $11.49 | $-0.02 |

| 6/24/2022 | $11.51 | $0.30 |

| 6/23/2022 | $11.21 | $0.16 |

| 6/22/2022 | $11.05 | $-0.03 |

| 6/21/2022 | $11.08 | $0.14 |

| 6/17/2022 | $10.94 | $0.06 |

| 6/16/2022 | $10.88 | $-0.30 |

| 6/15/2022 | $11.18 | $0.19 |

| 6/14/2022 | $10.99 | $-0.22 |

| 6/13/2022 | $11.21 | $-0.50 |

| 6/10/2022 | $11.71 | $-0.24 |

| 6/09/2022 | $11.95 | $-0.24 |

| 6/08/2022 | $12.19 | $-0.07 |

| 6/07/2022 | $12.26 | $0.05 |

| 6/06/2022 | $12.21 | $0.11 |

| 6/03/2022 | $12.10 | $0.00 |

| 6/02/2022 | $12.10 | $0.25 |

| 6/01/2022 | $11.85 | $-0.10 |

| 5/31/2022 | $11.95 | $-0.09 |

| 5/27/2022 | $12.04 | $0.07 |

| 5/26/2022 | $11.97 | $-0.04 |

| 5/25/2022 | $12.01 | $0.13 |

| 5/24/2022 | $11.88 | $-0.12 |

| 5/23/2022 | $12.00 | $0.17 |

| 5/20/2022 | $11.83 | $0.00 |

| 5/19/2022 | $11.83 | $0.15 |

| 5/18/2022 | $11.68 | $-0.03 |

| 5/17/2022 | $11.71 | $0.25 |

| 5/16/2022 | $11.46 | $0.11 |

| 5/13/2022 | $11.35 | $0.26 |

| 5/12/2022 | $11.09 | $-0.18 |

| 5/11/2022 | $11.27 | $0.01 |

| 5/10/2022 | $11.26 | $0.00 |

| 5/09/2022 | $11.26 | $-0.37 |

| 5/06/2022 | $11.63 | $-0.08 |

| 5/05/2022 | $11.71 | $-0.30 |

| 5/04/2022 | $12.01 | $0.27 |

| 5/03/2022 | $11.74 | $0.10 |

| 5/02/2022 | $11.64 | $-0.11 |

| 4/29/2022 | $11.75 | $-0.16 |

| 4/28/2022 | $11.91 | $0.11 |

| 4/27/2022 | $11.80 | $0.04 |

| 4/26/2022 | $11.76 | $-0.20 |

| 4/25/2022 | $11.96 | $-0.01 |

| 4/22/2022 | $11.97 | $-0.16 |

| 4/21/2022 | $12.13 | $-0.33 |

| 4/20/2022 | $12.46 | $0.02 |

| 4/19/2022 | $12.44 | $0.07 |

| 4/18/2022 | $12.37 | $-0.08 |

| 4/14/2022 | $12.45 | $-0.09 |

| 4/13/2022 | $12.54 | $0.05 |

| 4/12/2022 | $12.49 | $-0.13 |

| 4/11/2022 | $12.62 | $-0.20 |

| 4/08/2022 | $12.82 | $0.00 |

| 4/07/2022 | $12.82 | $-0.03 |

| 4/06/2022 | $12.85 | $0.07 |

| 4/05/2022 | $12.78 | $0.01 |

| 4/04/2022 | $12.77 | $0.06 |

| 4/01/2022 | $12.71 | $0.13 |

| 3/31/2022 | $12.58 | $-0.02 |

| 3/30/2022 | $12.60 | $0.17 |

| 3/29/2022 | $12.43 | $0.07 |

| 3/28/2022 | $12.36 | $0.17 |

| 3/25/2022 | $12.19 | $0.09 |

| 3/24/2022 | $12.10 | $0.10 |

| 3/23/2022 | $12.00 | $-0.21 |

| 3/22/2022 | $12.21 | $0.12 |

| 3/21/2022 | $12.09 | $-0.12 |

| 3/18/2022 | $12.21 | $0.00 |

| 3/17/2022 | $12.21 | $0.14 |

| 3/16/2022 | $12.07 | $0.11 |

| 3/15/2022 | $11.96 | $0.12 |

| 3/14/2022 | $11.84 | $-0.15 |

| 3/11/2022 | $11.99 | $-0.16 |

| 3/10/2022 | $12.15 | $-0.10 |

| 3/09/2022 | $12.25 | $0.21 |

| 3/08/2022 | $12.04 | $0.24 |

| 3/07/2022 | $11.80 | $0.15 |

| 3/04/2022 | $11.65 | $0.04 |

| 3/03/2022 | $11.61 | $-0.12 |

| 3/02/2022 | $11.73 | $0.11 |

| 3/01/2022 | $11.62 | $-0.16 |

| 2/28/2022 | $11.78 | $0.34 |

| 2/25/2022 | $11.44 | $0.28 |

| 2/24/2022 | $11.16 | $0.43 |

| 2/23/2022 | $10.73 | $-0.07 |

| 2/22/2022 | $10.80 | $-0.16 |

| 2/18/2022 | $10.96 | $-0.10 |

| 2/17/2022 | $11.06 | $-0.05 |

| 2/16/2022 | $11.11 | $-0.04 |

| 2/15/2022 | $11.15 | $0.19 |

| 2/14/2022 | $10.96 | $-0.10 |

| 2/11/2022 | $11.06 | $-0.13 |

| 2/10/2022 | $11.19 | $-0.16 |

| 2/09/2022 | $11.35 | $0.25 |

| 2/08/2022 | $11.10 | $-0.06 |

| 2/07/2022 | $11.16 | $-0.06 |

| 2/04/2022 | $11.22 | $-0.02 |

| 2/03/2022 | $11.24 | $-0.17 |

| 2/02/2022 | $11.41 | $0.08 |

| 2/01/2022 | $11.33 | $-0.01 |

| 1/31/2022 | $11.34 | $0.31 |

| 1/28/2022 | $11.03 | $0.02 |

| 1/27/2022 | $11.01 | $-0.11 |

| 1/26/2022 | $11.12 | $0.06 |

| 1/25/2022 | $11.06 | $-0.19 |

| 1/24/2022 | $11.25 | $-0.09 |

| 1/21/2022 | $11.34 | $-0.22 |

| 1/20/2022 | $11.56 | $0.05 |

| 1/19/2022 | $11.51 | $0.08 |

| 1/18/2022 | $11.43 | $-0.14 |

| 1/14/2022 | $11.57 | $-0.10 |

| 1/13/2022 | $11.67 | $-0.03 |

| 1/12/2022 | $11.70 | $0.03 |

| 1/11/2022 | $11.67 | $-0.01 |

| 1/10/2022 | $11.68 | $-0.09 |

| 1/07/2022 | $11.77 | $-0.03 |

| 1/06/2022 | $11.80 | $-0.21 |

| 1/05/2022 | $12.01 | $-0.34 |

| 1/04/2022 | $12.35 | $-0.14 |

| 1/03/2022 | $12.49 | $0.06 |

| 12/31/2021 | $12.43 | $0.07 |

| 12/30/2021 | $12.36 | $-0.23 |

| 12/29/2021 | $12.59 | $-0.08 |

| 12/28/2021 | $12.67 | $-0.07 |

| 12/27/2021 | $12.74 | $-0.06 |

| 12/23/2021 | $12.80 | $0.10 |

| 12/22/2021 | $12.70 | $0.08 |

| 12/21/2021 | $12.62 | $0.19 |

| 12/20/2021 | $12.43 | $-0.17 |

| 12/17/2021 | $12.60 | $-0.06 |

| 12/16/2021 | $12.66 | $0.06 |

| 12/15/2021 | $12.60 | $0.15 |

| 12/14/2021 | $12.45 | $-0.20 |

| 12/13/2021 | $12.65 | $0.00 |

| 12/10/2021 | $12.65 | $-0.11 |

| 12/09/2021 | $12.76 | $-0.01 |

| 12/08/2021 | $12.77 | $0.05 |

| 12/07/2021 | $12.72 | $0.11 |

| 12/06/2021 | $12.61 | $0.10 |

| 12/03/2021 | $12.51 | $-0.05 |

| 12/02/2021 | $12.56 | $-0.07 |

| 12/01/2021 | $12.63 | $-0.02 |

| 11/30/2021 | $12.65 | $-0.17 |

| 11/29/2021 | $12.82 | $0.09 |

| 11/26/2021 | $12.73 | $-0.16 |

| 11/24/2021 | $12.89 | $0.07 |

| 11/23/2021 | $12.82 | $-0.23 |

| 11/22/2021 | $13.05 | $-0.04 |

| 11/19/2021 | $13.09 | $0.01 |

| 11/18/2021 | $13.08 | $-0.01 |

| 11/17/2021 | $13.09 | $-0.06 |

| 11/16/2021 | $13.15 | $-0.08 |

| 11/15/2021 | $13.23 | $-0.03 |

| 11/12/2021 | $13.26 | $0.09 |

| 11/11/2021 | $13.17 | $0.07 |

| 11/10/2021 | $13.10 | $-0.21 |

| 11/09/2021 | $13.31 | $0.02 |

| 11/08/2021 | $13.29 | $-0.09 |

| 11/05/2021 | $13.38 | $-0.07 |

| 11/04/2021 | $13.45 | $0.04 |

| 11/03/2021 | $13.41 | $-0.02 |

| 11/02/2021 | $13.43 | $-0.11 |

| 11/01/2021 | $13.54 | $0.17 |

| 10/29/2021 | $13.37 | $-0.19 |

| 10/28/2021 | $13.56 | $0.22 |

| 10/27/2021 | $13.34 | $0.07 |

| 10/26/2021 | $13.27 | $-0.02 |

| 10/25/2021 | $13.29 | $0.07 |

| 10/22/2021 | $13.22 | $-0.04 |

| 10/21/2021 | $13.26 | $-0.04 |

| 10/20/2021 | $13.30 | $0.15 |

| 10/19/2021 | $13.15 | $0.33 |

| 10/18/2021 | $12.82 | $-0.09 |

| 10/15/2021 | $12.91 | $0.11 |

| 10/14/2021 | $12.80 | $0.02 |

| 10/13/2021 | $12.78 | $0.24 |

| 10/12/2021 | $12.54 | $0.22 |

| 10/11/2021 | $12.32 | $-0.21 |

| 10/08/2021 | $12.53 | $-0.19 |

| 10/07/2021 | $12.72 | $0.04 |

| 10/06/2021 | $12.68 | $0.03 |

| 10/05/2021 | $12.65 | $0.03 |

| 10/04/2021 | $12.62 | $-0.14 |

| 10/01/2021 | $12.76 | $0.03 |

| 9/30/2021 | $12.73 | $0.01 |

| 9/29/2021 | $12.72 | $-0.07 |

| 9/28/2021 | $12.79 | $-0.19 |

| 9/27/2021 | $12.98 | $-0.11 |

| 9/24/2021 | $13.09 | $-0.08 |

| 9/23/2021 | $13.17 | $0.25 |

| 9/22/2021 | $12.92 | $0.02 |

| 9/21/2021 | $12.90 | $0.14 |

| 9/20/2021 | $12.76 | $-0.11 |

| 9/17/2021 | $12.87 | $-0.01 |

| 9/16/2021 | $12.88 | $-0.05 |

| 9/15/2021 | $12.93 | $-0.05 |

| 9/14/2021 | $12.98 | $-0.07 |

| 9/13/2021 | $13.05 | $0.08 |

| 9/10/2021 | $12.97 | $-0.12 |

| 9/09/2021 | $13.09 | $0.00 |

| 9/08/2021 | $13.09 | $0.07 |

| 9/07/2021 | $13.02 | $0.03 |

| 9/03/2021 | $12.99 | $0.01 |

| 9/02/2021 | $12.98 | $0.15 |

| 9/01/2021 | $12.83 | $0.12 |

| 8/31/2021 | $12.71 | $0.02 |

| 8/30/2021 | $12.69 | $0.14 |

| 8/27/2021 | $12.55 | $-0.01 |

| 8/26/2021 | $12.56 | $-0.15 |

| 8/25/2021 | $12.71 | $-0.01 |

| 8/24/2021 | $12.72 | $-0.02 |

| 8/23/2021 | $12.74 | $0.12 |

| 8/20/2021 | $12.62 | $0.15 |

| 8/19/2021 | $12.47 | $-0.01 |

| 8/18/2021 | $12.48 | $0.06 |

| 8/17/2021 | $12.42 | $-0.11 |

| 8/16/2021 | $12.53 | $-0.08 |

| 8/13/2021 | $12.61 | $0.02 |

| 8/12/2021 | $12.59 | $-0.06 |

| 8/11/2021 | $12.65 | $0.06 |

| 8/10/2021 | $12.59 | $-0.04 |

| 8/09/2021 | $12.63 | $0.09 |

| 8/06/2021 | $12.54 | $-0.15 |

| 8/05/2021 | $12.69 | $0.03 |

| 8/04/2021 | $12.66 | $-0.03 |

| 8/03/2021 | $12.69 | $0.06 |

| 8/02/2021 | $12.63 | $0.02 |

| 7/30/2021 | $12.61 | $-0.01 |

| 7/29/2021 | $12.62 | $0.03 |

| 7/28/2021 | $12.59 | $0.22 |

| 7/27/2021 | $12.37 | $0.04 |

| 7/26/2021 | $12.33 | $-0.12 |

| 7/23/2021 | $12.45 | $-0.11 |

| 7/22/2021 | $12.56 | $0.05 |

| 7/21/2021 | $12.51 | $0.20 |

| 7/20/2021 | $12.31 | $0.09 |

| 7/19/2021 | $12.22 | $-0.17 |

| 7/16/2021 | $12.39 | $0.01 |

| 7/15/2021 | $12.38 | $-0.15 |

| 7/14/2021 | $12.53 | $-0.03 |

| 7/13/2021 | $12.56 | $-0.03 |

| 7/12/2021 | $12.59 | $0.16 |

| 7/09/2021 | $12.43 | $0.03 |

| 7/08/2021 | $12.40 | $-0.17 |

| 7/07/2021 | $12.57 | $0.14 |

| 7/06/2021 | $12.43 | $0.00 |

| 7/02/2021 | $12.43 | $0.11 |

| 7/01/2021 | $12.32 | $0.08 |

| 6/30/2021 | $12.24 | $-0.17 |

| 6/29/2021 | $12.41 | $0.06 |

| 6/28/2021 | $12.35 | $0.07 |

| 6/25/2021 | $12.28 | $0.08 |

| 6/24/2021 | $12.20 | $0.04 |

| 6/23/2021 | $12.16 | $-0.07 |

| 6/22/2021 | $12.23 | $0.16 |

| 6/21/2021 | $12.07 | $0.06 |

| 6/18/2021 | $12.01 | $-0.19 |

| 6/17/2021 | $12.20 | $-0.04 |

| 6/16/2021 | $12.24 | $-0.01 |

| 6/15/2021 | $12.25 | $-0.09 |

| 6/14/2021 | $12.34 | $0.15 |

| 6/11/2021 | $12.19 | $0.09 |

| 6/10/2021 | $12.10 | $0.09 |

| 6/09/2021 | $12.01 | $0.13 |

| 6/08/2021 | $11.88 | $0.07 |

| 6/07/2021 | $11.81 | $0.01 |

| 6/04/2021 | $11.80 | $0.06 |

| 6/03/2021 | $11.74 | $-0.11 |

| 6/02/2021 | $11.85 | $-0.04 |

| 6/01/2021 | $11.89 | $-0.04 |

| 5/28/2021 | $11.93 | $0.04 |

| 5/27/2021 | $11.89 | $-0.16 |

| 5/26/2021 | $12.05 | $0.00 |

| 5/25/2021 | $12.05 | $-0.05 |

| 5/24/2021 | $12.10 | $0.02 |

| 5/21/2021 | $12.08 | $0.07 |

| 5/20/2021 | $12.01 | $0.24 |

| 5/19/2021 | $11.77 | $0.02 |

| 5/18/2021 | $11.75 | $0.09 |

| 5/17/2021 | $11.66 | $-0.08 |

| 5/14/2021 | $11.74 | $0.23 |

| 5/13/2021 | $11.51 | $0.11 |

| 5/12/2021 | $11.40 | $-0.27 |

| 5/11/2021 | $11.67 | $-0.15 |

| 5/10/2021 | $11.82 | $-0.13 |

| 5/07/2021 | $11.95 | $0.10 |

| 5/06/2021 | $11.85 | $-0.01 |

| 5/05/2021 | $11.86 | $-0.03 |

| 5/04/2021 | $11.89 | $-0.21 |

| 5/03/2021 | $12.10 | $-0.02 |

| 4/30/2021 | $12.12 | $-0.16 |

| 4/29/2021 | $12.28 | $-0.08 |

| 4/28/2021 | $12.36 | $-0.08 |

| 4/27/2021 | $12.44 | $-0.05 |

| 4/26/2021 | $12.49 | $0.01 |

| 4/23/2021 | $12.48 | $0.11 |

| 4/22/2021 | $12.37 | $0.09 |

| 4/21/2021 | $12.28 | $0.02 |

| 4/20/2021 | $12.26 | $-0.05 |

| 4/19/2021 | $12.31 | $-0.19 |

| 4/16/2021 | $12.50 | $0.09 |

| 4/15/2021 | $12.41 | $0.03 |

| 4/14/2021 | $12.38 | $-0.05 |

| 4/13/2021 | $12.43 | $0.07 |

| 4/12/2021 | $12.36 | $-0.04 |

| 4/09/2021 | $12.40 | $-0.05 |

| 4/08/2021 | $12.45 | $0.12 |

| 4/07/2021 | $12.33 | $-0.05 |

| 4/06/2021 | $12.38 | $0.06 |

| 4/05/2021 | $12.32 | $-0.01 |

| 4/01/2021 | $12.33 | $0.07 |

| 3/31/2021 | $12.26 | $0.14 |

| 3/30/2021 | $12.12 | $0.03 |

| 3/29/2021 | $12.09 | $-0.03 |

| 3/26/2021 | $12.12 | $0.22 |

| 3/25/2021 | $11.90 | $0.01 |

| 3/24/2021 | $11.89 | $-0.13 |

| 3/23/2021 | $12.02 | $-0.01 |

| 3/22/2021 | $12.03 | $0.20 |

| 3/19/2021 | $11.83 | $0.08 |

| 3/18/2021 | $11.75 | $-0.27 |

| 3/17/2021 | $12.02 | $-0.16 |

| 3/16/2021 | $12.18 | $0.06 |

| 3/15/2021 | $12.12 | $0.04 |

| 3/12/2021 | $12.08 | $-0.04 |

| 3/11/2021 | $12.12 | $0.31 |

| 3/10/2021 | $11.81 | $0.14 |

| 3/09/2021 | $11.67 | $0.33 |

| 3/08/2021 | $11.34 | $-0.10 |

| 3/05/2021 | $11.44 | $-0.05 |

| 3/04/2021 | $11.49 | $-0.15 |

| 3/03/2021 | $11.64 | $-0.43 |

| 3/02/2021 | $12.07 | $-0.11 |

| 3/01/2021 | $12.18 | $0.31 |

| 2/26/2021 | $11.87 | $-0.10 |

| 2/25/2021 | $11.97 | $-0.15 |

| 2/24/2021 | $12.12 | $-0.07 |

| 2/23/2021 | $12.19 | $-0.05 |

| 2/22/2021 | $12.24 | $-0.32 |

| 2/19/2021 | $12.56 | $-0.03 |

| 2/18/2021 | $12.59 | $-0.26 |

| 2/17/2021 | $12.85 | $-0.16 |

| 2/16/2021 | $13.01 | $-0.03 |

| 2/12/2021 | $13.04 | $-0.13 |

| 2/11/2021 | $13.17 | $0.11 |

| 2/10/2021 | $13.06 | $0.02 |

| 2/09/2021 | $13.04 | $-0.08 |

| 2/08/2021 | $13.12 | $0.01 |

| 2/05/2021 | $13.11 | $0.03 |

| 2/04/2021 | $13.08 | $-0.01 |

| 2/03/2021 | $13.09 | $0.07 |

| 2/02/2021 | $13.02 | $0.09 |

| 2/01/2021 | $12.93 | $0.14 |

| 1/29/2021 | $12.79 | $-0.18 |

| 1/28/2021 | $12.97 | $0.09 |

| 1/27/2021 | $12.88 | $-0.52 |

| 1/26/2021 | $13.40 | $-0.17 |

| 1/25/2021 | $13.57 | $-0.09 |

| 1/22/2021 | $13.66 | $0.09 |

| 1/21/2021 | $13.57 | $0.02 |

| 1/20/2021 | $13.55 | $0.20 |

| 1/19/2021 | $13.35 | $0.12 |

| 1/15/2021 | $13.23 | $-0.20 |

| 1/14/2021 | $13.43 | $-0.14 |

| 1/13/2021 | $13.57 | $0.05 |

| 1/12/2021 | $13.52 | $-0.08 |

| 1/11/2021 | $13.60 | $-0.33 |

| 1/08/2021 | $13.93 | $0.17 |

| 1/07/2021 | $13.76 | $0.30 |

| 1/06/2021 | $13.46 | $0.58 |

| 1/05/2021 | $12.88 | $0.08 |

| 1/04/2021 | $12.80 | $0.28 |

| 12/31/2020 | $12.52 | $0.03 |

| 12/30/2020 | $12.49 | $-0.02 |

| 12/29/2020 | $12.51 | $0.06 |

| 12/28/2020 | $12.45 | $0.17 |

| 12/24/2020 | $12.28 | $0.12 |

| 12/23/2020 | $12.16 | $0.22 |

| 12/22/2020 | $11.94 | $0.09 |

| 12/21/2020 | $11.85 | $-0.07 |

| 12/18/2020 | $11.92 | $0.02 |

| 12/17/2020 | $11.90 | $0.13 |

| 12/16/2020 | $11.77 | $0.02 |

| 12/15/2020 | $11.75 | $0.23 |

| 12/14/2020 | $11.52 | $0.10 |

| 12/11/2020 | $11.42 | $0.01 |

| 12/10/2020 | $11.41 | $0.05 |

| 12/09/2020 | $11.36 | $-0.11 |

| 12/08/2020 | $11.47 | $0.05 |

| 12/07/2020 | $11.42 | $-0.01 |

| 12/04/2020 | $11.43 | $-0.03 |

| 12/03/2020 | $11.46 | $0.00 |

| 12/02/2020 | $11.46 | $-0.03 |

| 12/01/2020 | $11.49 | $0.07 |

| 11/30/2020 | $11.42 | $-0.14 |

| 11/27/2020 | $11.56 | $0.11 |

| 11/25/2020 | $11.45 | $0.09 |

| 11/24/2020 | $11.36 | $0.08 |

| 11/23/2020 | $11.28 | $0.06 |

| 11/20/2020 | $11.22 | $0.07 |

| 11/19/2020 | $11.15 | $0.02 |

| 11/18/2020 | $11.13 | $-0.10 |

| 11/17/2020 | $11.23 | $0.01 |

| 11/16/2020 | $11.22 | $0.01 |

| 11/13/2020 | $11.21 | $0.07 |

| 11/12/2020 | $11.14 | $-0.04 |

| 11/11/2020 | $11.18 | $0.25 |

| 11/10/2020 | $10.93 | $-0.02 |

| 11/09/2020 | $10.95 | $0.07 |

| 11/06/2020 | $10.88 | $0.04 |

| 11/05/2020 | $10.84 | $0.30 |

| 11/04/2020 | $10.54 | $-0.05 |

| 11/03/2020 | $10.59 | $0.17 |

| 11/02/2020 | $10.42 | $0.18 |

| 10/30/2020 | $10.24 | $0.03 |

| 10/29/2020 | $10.21 | $0.00 |

| 10/28/2020 | $10.21 | $-0.19 |

| 10/27/2020 | $10.40 | $-0.06 |

| 10/26/2020 | $10.46 | $-0.10 |

| 10/23/2020 | $10.56 | $0.03 |

| 10/22/2020 | $10.53 | $0.01 |

| 10/21/2020 | $10.52 | $-0.11 |

| 10/20/2020 | $10.63 | $0.07 |

| 10/19/2020 | $10.56 | $-0.07 |

| 10/16/2020 | $10.63 | $0.06 |

| 10/15/2020 | $10.57 | $-0.08 |

| 10/14/2020 | $10.65 | $0.04 |

| 10/13/2020 | $10.61 | $-0.02 |

| 10/12/2020 | $10.63 | $0.03 |

| 10/09/2020 | $10.60 | $0.02 |

| 10/08/2020 | $10.58 | $0.10 |

| 10/07/2020 | $10.48 | $0.16 |

| 10/06/2020 | $10.32 | $0.04 |

| 10/05/2020 | $10.28 | $0.15 |

| 10/02/2020 | $10.13 | $0.00 |

| 10/01/2020 | $10.13 | $0.15 |

| 9/30/2020 | $9.98 | $0.07 |

| 9/29/2020 | $9.91 | $0.06 |

| 9/28/2020 | $9.85 | $0.13 |

| 9/25/2020 | $9.72 | $0.15 |

| 9/24/2020 | $9.57 | $0.02 |

| 9/23/2020 | $9.55 | $-0.10 |

| 9/22/2020 | $9.65 | $0.05 |

| 9/21/2020 | $9.60 | $-0.14 |

| 9/18/2020 | $9.74 | $-0.04 |

| 9/17/2020 | $9.78 | $-0.03 |

| 9/16/2020 | $9.81 | $-0.04 |

| 9/15/2020 | $9.85 | $0.11 |

| 9/14/2020 | $9.74 | $0.02 |

| 9/11/2020 | $9.72 | $0.04 |

| 9/10/2020 | $9.68 | $-0.09 |

| 9/09/2020 | $9.77 | $0.16 |

| 9/08/2020 | $9.61 | $-0.05 |

| 9/04/2020 | $9.66 | $-0.17 |

| 9/03/2020 | $9.83 | $-0.25 |

| 9/02/2020 | $10.08 | $0.10 |

| 9/01/2020 | $9.98 | $-0.01 |

| 8/31/2020 | $9.99 | $0.00 |

| 8/28/2020 | $9.99 | $0.05 |

| 8/27/2020 | $9.94 | $-0.01 |

| 8/26/2020 | $9.95 | $-0.02 |

| 8/25/2020 | $9.97 | $-0.02 |

| 8/24/2020 | $9.99 | $0.11 |

| 8/21/2020 | $9.88 | $-0.01 |

| 8/20/2020 | $9.89 | $-0.04 |

| 8/19/2020 | $9.93 | $0.00 |

| 8/18/2020 | $9.93 | $-0.08 |

| 8/17/2020 | $10.01 | $0.05 |

| 8/14/2020 | $9.96 | $-0.08 |

| 8/13/2020 | $10.04 | $-0.01 |

| 8/12/2020 | $10.05 | $0.14 |

| 8/11/2020 | $9.91 | $-0.12 |

| 8/10/2020 | $10.03 | $0.03 |

| 8/07/2020 | $10.00 | $0.00 |

The Ecofin Global Renewables Infrastructure Fund is an impact fund investing in listed companies that own low-carbon power generation assets.

Fund Stats as of 7/25/2024:

NAV

$9.49

NAV Change

$-0.04

Objective

Total return

CUSIP

56167N480

Minimum Investment

$2,500.00

Expense Ratio Gross

1.31%

Expense Ratio Net

1.25%

Redemption Fee

None

Max Front-End Sales Load

5.50%

Max Deferred Sales Load

None

The Ecofin Global Renewables Infrastructure Fund is an impact fund investing in listed companies that own low-carbon power generation assets. The fund invests in companies riding on the high demand growth for clean electricity. The portfolio has the goal of providing a low beta and delivers a measurable decarbonization benefit.

Key reasons to invest

- Access the fast growing decarbonization theme

– Electricity taking substantial share from other energy sources

– Accelerating transition to cleaner electricity generation

- Track record of strong performance with lower risk than the market1

- Measurable impact on emissions reduction

Produced by MSCI ESG Research as of June 30, 2024.

Produced by MSCI ESG Research as of June 30, 2024.

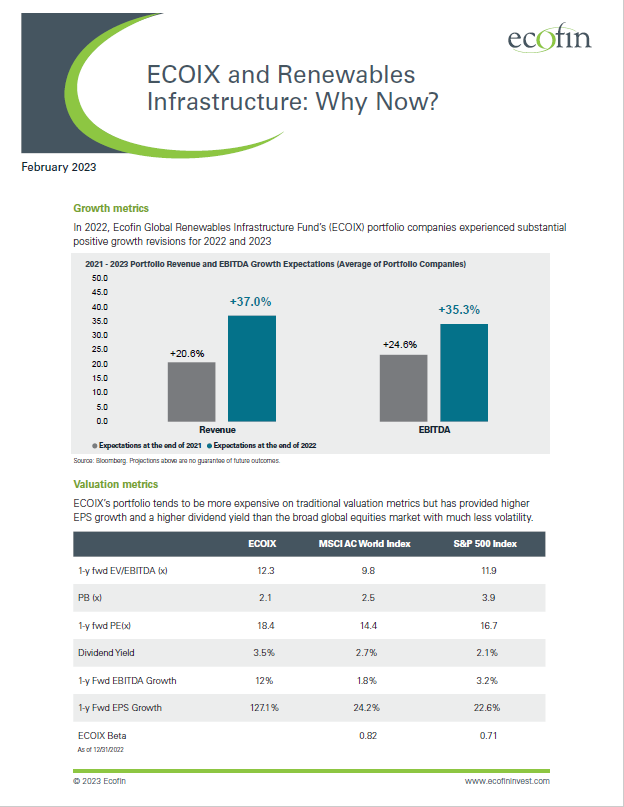

| Fund Details | As of 6/30/2024 |

|---|---|

| Total Assets | $248.4 million |

| Objective | Total return |

| Inception Date | 8/07/2020 |

| Beta 1 | 0.74 |

Beta since inception as of 6/30/2024

Beta is a measure of a stock's volatility in relation to the overall market.

Impact

$1 million investment implies the avoidance of 453 tonnes of carbon per year

Equivalent to the emissions from:

- 408 round-trip flights from New York to Los Angeles

- 57 car trips around the world

as of 6/30/2024

- Clear calculable impact in terms of CO2 emissions avoided

- Effective displacement of dirty electricity generation by the cleaner generation of portfolio constituents

- The fund is 63.1% cleaner than the respective grids in which the underlying companies operate

About Ecofin

Ecofin unites ecology and finance and has roots back to the early 1990s. Our mission is to generate strong risk-adjusted returns and measurable impacts. We invest in essential assets and services that contribute to more sustainable human ecosystems and communities. We are socially-minded, ESG-attentive investors, successfully harnessing years of expertise investing in social impact, sustainable infrastructure, energy transition and clean water & environment. Our strategies are accessible through a variety of investment solutions and seek to achieve positive impacts that align with UN Sustainable Development Goals by addressing pressing global issues surrounding climate action, clean energy and water, education, healthcare and sustainable communities.

This strategy seeks to achieve positive impacts that align with the following UN Sustainable Development Goals*

Portfolio

As of 6/30/2024

Top 10 Holdings *

| Company | % of Total |

|---|---|

Clearway Energy, Inc. CWEN

| 6.0% |

ReNew Energy Global PLC RNW

| 6.0% |

ERG S.p.A. ERG IM

| 5.9% |

Neoen NEOEN FP

| 5.8% |

Dominion Energy, Inc. D

| 5.5% |

| Company | % of Total |

|---|---|

Edison International EIX

| 5.3% |

NextEra Energy Partners LP NEP

| 5.3% |

Exelon Corporation EXC

| 5.3% |

Innergex Renewable Energy Inc INE CN

| 5.0% |

Avista Corp AVA

| 4.9% |

Top 10 Holdings as % of Investment Securities: 55.0%

* Fund holdings are subject to change and are not recommendations to buy or sell any security.

| Class/Name | QTD | Calendar YTD | 1 Year | 3 Year | 5 year | Since Inception 1 |

|---|---|---|---|---|---|---|

| ECOIX | 5.57% | -1.68% | -6.59% | -5.66% | 6.19% | 7.75% |

| ECOAX (excluding load) | 5.46% | -1.79% | -6.81% | -5.91% | 5.96% | 7.51% |

| ECOAX (maximum load) | -0.31% | -7.19% | -11.90% | -7.66% | 4.76% | 6.81% |

| S&P Global Infrastructure Index (Net TR) | 2.33% | 3.48% | 5.97% | 4.66% | 3.45% | 5.35% |

| S&P Global Infrastructure Index (TR) | 2.67% | 4.04% | 7.02% | 5.59% | 4.33% | 6.30% |

| Class/Name | 1 Month | Calendar YTD | 1 Year | 3 Year | 5 year | Since Inception 1 |

|---|---|---|---|---|---|---|

| ECOIX | -5.95% | -1.68% | -6.59% | -5.66% | 6.19% | 7.75% |

| ECOAX (excluding load) | -6.06% | -1.79% | -6.81% | -5.91% | 5.96% | 7.51% |

| ECOAX (maximum load) | -11.25% | -7.19% | -11.90% | -7.66% | 4.76% | 6.81% |

| S&P Global Infrastructure Index (Net TR) | -3.04% | 3.48% | 5.97% | 4.66% | 3.45% | 5.35% |

| S&P Global Infrastructure Index (TR) | -2.92% | 4.04% | 7.02% | 5.59% | 4.33% | 6.30% |

Expense Ratios

| Ticker | Class/Name | Expense Ratio |

|---|---|---|

| ECOIX | Institutional | 0.94% |

| ECOAX | A Class | 1.20% |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-822-3863. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. For periods over one year, performance reflected is for the average annual returns.

The Ecofin Global Renewables Infrastructure Fund (the Fund) is a newly registered mutual fund and does not have a full calendar year of performance as a mutual fund. Prior performance shown above is for the Ecofin Global Renewables Infrastructure Fund Limited, established in November 2015 (which later changed its name to the Tortoise Global Renewables Infrastructure Fund Limited in May 2019), (the “Predecessor Fund”), an unregistered Cayman Islands limited liability company. The Predecessor Fund was reorganized into the Fund by transferring the majority of the Predecessor Fund’s assets to the Fund in exchange for Institutional Class shares of the Fund on August 7, 2020, the date that the Fund commenced operations (the “Reorganization”). The Predecessor Fund has been managed in the same style as the Fund. The Sub-Adviser served as the investment adviser to the Predecessor Fund and will be responsible for the portfolio management and trading for the Fund. Each of the Fund’s portfolio managers was a portfolio manager of the Predecessor Fund at the time of the Reorganization. The Fund’s investment objective, policies, guidelines and restrictions are, in all material respects, the same as those of the Predecessor Fund.

The above information shows the returns of the commingled Predecessor Fund since its inception in November 2015. The performance of the commingled Predecessor Fund represents that of its Early Investor Shares, which are similar to the Fund’s Institutional class but, at a point in time, were subject to performance and other fees. Prior to the launch of the fund, the Predecessor Fund reported official NAV on Wednesdays. The historical net return of the Predecessor Fund was adjusted to a calendar month end in the presentation above using the nearest weekly official valuation point and the returns and expense accruals were rolled forward. From its inception through the date of the Reorganization, the Predecessor Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended (the “1940 Act”) or Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), which, if they had been applicable, might have adversely affected the Predecessor Fund’s performance. After the Reorganization, the Fund’s performance will be calculated using the standard formula set forth in rules promulgated by the SEC, which differs in certain respects from the methods used to compute total return for the Predecessor Fund.

Index performance reflects no deduction for fees, expenses, or taxes. The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. The net total return (Net TR) version of the index, reinvests regular cash dividends at the close on the ex-date after the deduction of applicable withholding taxes. The total return (TR) version of the index reinvests regular cash dividends at the close on the ex-date without consideration for withholding taxes. It is not possible to invest directly in an index.

Prior performance shown above is for the Ecofin Global Renewables Infrastructure Fund Limited, established in November 2015 (which later changed its name to the Tortoise Global Renewables Infrastructure Fund Limited in May 2019), (the “Predecessor Fund”), an unregistered Cayman Islands limited liability company. The Predecessor Fund was reorganized into the Fund by transferring substantially all of the Predecessor Fund’s assets to the Fund in exchange for Institutional Class shares of the Fund on August 7, 2020, the date that the Fund commenced operations (the “Reorganization”). The Predecessor Fund has been managed in the same style as the Fund. The Sub-Adviser served as the investment adviser to the Predecessor Fund and will be responsible for the portfolio management and trading for the Fund. Each of the Fund’s portfolio managers was a portfolio manager of the Predecessor Fund at the time of the Reorganization. The Fund’s investment objective, policies, guidelines and restrictions are, in all material respects, the same as those of the Predecessor Fund.

NAV History

Ecofin Global Renewables Infrastructure Fund ECOAX

Distribution Detail

See complete history Hide complete history| Class/Name | Ticker | Ex-Date | Record Date | Payment Date | Amount | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| A Class | ECOAX | 12/30/2024 | 12/27/2024 | 12/30/2024 | N/A | ||||||

| A Class | ECOAX | 11/26/2024 | 11/25/2024 | 11/26/2024 | N/A | ||||||

| A Class | ECOAX | 5/23/2024 | 5/22/2024 | 5/23/2024 | $0.1440 | ||||||

| 2024 Total: | $0.1440 | ||||||||||

| 2024 Total: $0.14400 | |||||||||||

| A Class | ECOAX | 12/28/2023 | 12/27/2023 | 12/28/2023 | $0.0807 | ||||||

| A Class | ECOAX | 11/28/2023 | 11/27/2023 | 11/28/2023 | $0.1360 | ||||||

| A Class | ECOAX | 5/25/2023 | 5/24/2023 | 5/25/2023 | $0.1249 | ||||||

| 2023 Total: | $0.3416 | ||||||||||

| 2023 Total: $0.34160 | |||||||||||

| A Class | ECOAX | 12/29/2022 | 12/28/2022 | 12/29/2022 | $0.0651 | ||||||

| A Class | ECOAX | 11/22/2022 | 11/21/2022 | 11/22/2022 | $0.13821 | ||||||

| A Class | ECOAX | 5/26/2022 | 5/25/2022 | 5/26/2022 | $0.1159 | ||||||

| 2022 Total: | $0.31921 | ||||||||||

| 2022 Total: $0.31921 | |||||||||||

| A Class | ECOAX | 12/30/2021 | 12/29/2021 | 12/30/2021 | 0.2920 | ||||||

| A Class | ECOAX | 11/23/2021 | 11/22/2021 | 11/23/2021 | 0.0949 | ||||||

| A Class | ECOAX | 5/27/2021 | 5/26/2021 | 5/27/2021 | 0.1112 | ||||||

| 2021 Total: | $0.4981 | ||||||||||

| 2021 Total: $0.49810 | |||||||||||

| A Class | ECOAX | 12/30/2020 | 12/29/2020 | 12/30/2020 | 0.13669 | ||||||

| A Class | ECOAX | 11/24/2020 | 11/23/2020 | 11/24/2020 | 0.01211 | ||||||

| 2020 Total: | $0.14880 | ||||||||||

| 2020 Total: $0.14880 | |||||||||||

Tax Information

Find information and other tax-related resources for Ecofin mutual funds. Tax forms, publications and instructions are available for download from the IRS website.

Annual 1099-DIV

| Ticker | CUSIP | Total Distributions Per Share | Total Ordinary Dividends Box 1a 1 | Qualified Dividends Box 1b 2 | Capital Gain Distributions Box 2a 3 | Nondividend Distributions Box 3 4 | Foreign Tax Paid Box 7 5 |

|---|---|---|---|---|---|---|---|

| ECOIX | 56167N472 | $0.3548 | $0.0889 | $0.0828 | $0.0000 | $0.2720 | $0.0061 |

| ECOAX | 56167N480 | $0.3416 | $0.0868 | $0.0807 | $0.0000 | $0.2609 | $0.0061 |

-

Ordinary dividends are taxed at ordinary income tax rates.

-

The portion of ordinary dividends characterized as qualified dividend income will be taxable at the reduced capital gain tax rates if the stockholder meets the holding period requirements.

-

Capital gain distributions (long-term) are taxed at the reduced capital gain tax rates.

-

Nondividend distributions are nontaxable and considered return of capital.

-

Foreign Tax Paid may be eligible for deduction or foreign tax credit.

Nothing contained in this communication constitutes tax, legal or investment advice. Investors must consult their tax adviser or legal counsel for advice and information concerning their particular situation.

Annual 1099-DIV

| Ticker | CUSIP | Total Distributions Per Share | Total Ordinary Dividends Box 1a 1 | Qualified Dividends Box 1b 2 | Capital Gain Distributions Box 2a 3 | Nondividend Distributions Box 3 4 | Foreign Tax Paid Box 7 5 |

|---|---|---|---|---|---|---|---|

| ECOIX | 56167N472 | $0.3347 | $0.2301 | $0.1665 | $0.0000 | $0.1178 | $0.0132 |

| ECOAX | 56167N480 | $0.3192 | $0.2203 | $0.1594 | $0.0000 | $0.1121 | $0.0132 |

-

Ordinary dividends are taxed at ordinary income tax rates.

-

The portion of ordinary dividends characterized as qualified dividend income will be taxable at the reduced capital gain tax rates if the stockholder meets the holding period requirements.

-

Capital gain distributions (long-term) are taxed at the reduced capital gain tax rates.

-

Nondividend distributions are nontaxable and considered return of capital.

-

Foreign Tax Paid may be eligible for deduction or foreign tax credit.

Nothing contained in this communication constitutes tax, legal or investment advice. Investors must consult their tax adviser or legal counsel for advice and information concerning their particular situation.

Annual 1099-DIV

| Date | Ticker | CUSIP | Total Distributions Per Share | Total Ordinary Dividends Box 1a 1 | Qualified Dividends Box 1b 2 | Capital Gain Distributions Box 2a 3 | Nondividend Distributions Box 3 4 | Foreign Tax Paid Box 7 5 |

|---|---|---|---|---|---|---|---|---|

| 1/28/2021 | ECOIX | 56167N472 | $0.5289 | $0.3480 | $0.2429 | $0.1976 | $0.0000 | $0.0167 |

| 1/28/2021 | ECOAX | 56167N480 | $0.4982 | $0.3173 | $0.2214 | $0.1976 | $0.0000 | $0.0167 |

-

Ordinary dividends are taxed at ordinary income tax rates.

-

The portion of ordinary dividends characterized as qualified dividend income will be taxable at the reduced capital gain tax rates if the stockholder meets the holding period requirements.

-

Capital gain distributions (long-term) are taxed at the reduced capital gain tax rates.

-

Nondividend distributions are nontaxable and considered return of capital.

-

Foreign Tax Paid may be eligible for deduction or foreign tax credit.

Annual 1099-DIV

| Ticker | CUSIP | Total Distributions Per Share | Total Ordinary Dividends Box 1a 1 | Qualified Dividends Box 1b 2 | Capital Gain Distributions Box 2a 3 | Nondividend Distributions Box 3 4 | Foreign Tax Paid Box 7 5 |

|---|---|---|---|---|---|---|---|

| ECOIX | 56167N472 | $0.1619 | $0.1674 | $0.0612 | $0.0000 | $0.0000 | $0.0055 |

| ECOAX | 56167N480 | $0.1488 | $0.1543 | $0.0564 | $0.0000 | $0.0000 | $0.0055 |

-

Ordinary dividends are taxed at ordinary income tax rates.

-

The portion of ordinary dividends characterized as qualified dividend income will be taxable at the reduced capital gain tax rates if the stockholder meets the holding period requirements.

-

Capital gain distributions (long-term) are taxed at the reduced capital gain tax rates.

-

Nondividend distributions are nontaxable and considered return of capital.

-

Foreign Tax Paid may be eligible for deduction or foreign tax credit.